- Financial Freedom Frontier - Invest Safely & Smartly

- Posts

- AI Explosion: The Top Stocks You Can't Afford to Ignore in 2024

AI Explosion: The Top Stocks You Can't Afford to Ignore in 2024

Find out which AI powerhouses are poised to dominate the market and how you can profit from their ascent

In-Depth Analysis: Top 5 AI-Driven Stocks to Invest in for 2024

As Artificial Intelligence (AI) becomes increasingly integrated into various sectors, from healthcare to finance, its economic impact continues to grow. Here’s an analysis of five companies that stand at the forefront of this transformative technology, providing crucial insights and detailed financial metrics to guide investors.

Image from Investorplace.com

Nvidia (NASDAQ: NVDA)

Core Technologies: Nvidia’s GPUs are central to AI for tasks ranging from computer vision to complex simulations, making it a key player in the AI hardware market.

Financial Growth: In 2024, Nvidia's revenue increased by 57%, driven by high demand in sectors like gaming, data centers, and AI applications.

Strategic Acquisitions: The acquisition of Arm for $40 billion, pending regulatory approval, could significantly enhance Nvidia’s capabilities in mobile and IoT devices, areas expected to benefit extensively from AI.

Market Position: Nvidia has a robust market capitalization of over $300 billion, reflecting its dominant position in the technology sector.

Future Prospects: Nvidia is investing in next-generation AI, including AI data centers and autonomous machine solutions, which could further its growth.

The most compelling reason to invest in Nvidia (NVDA) lies in its dominant position in the rapidly expanding field of artificial intelligence (AI). Nvidia's graphics processing units (GPUs) are foundational to AI research and development, powering everything from autonomous vehicles and robotics to complex data analysis and cloud computing. This technological leadership is not just about hardware; Nvidia is also at the forefront of AI software development, offering a comprehensive ecosystem that includes AI platforms like CUDA, deep learning libraries, and more.

Nvidia's GPUs are the standard in a variety of industries that require high-performance computing, making it a critical player in markets that are set to grow exponentially as AI applications expand. Additionally, Nvidia's financial performance has been robust, with strong revenue growth and a solid track record of market innovation. This positions Nvidia as a strong candidate for long-term growth as AI becomes increasingly integral to various global industries.

Amazon (NASDAQ: AMZN)

Operational Efficiency: Amazon uses AI to optimize its supply chain and improve delivery efficiency, which is crucial for maintaining its e-commerce dominance.

AWS’s Market Share: AWS holds a 34% share in the global cloud market as of 2024, with significant contributions from its expansive suite of AI services.

Revenue Contributions: AWS generated revenues of $53 billion in 2024, accounting for over 13% of Amazon's total revenue.

Innovative Projects: Amazon is pioneering projects in AI-driven fields such as drone delivery and AI healthcare diagnostics, showcasing its commitment to innovation.

|

At the heart of Amazon (AMZN) is its diversified business model and strong competitive positioning in multiple high-growth industries. Amazon is not just an e-commerce giant; it also leads the cloud computing space with its Amazon Web Services (AWS), which is a major revenue driver for the company. AWS provides stable, high-margin income, which supports the company's investments and innovations in other areas such as artificial intelligence, streaming media, and consumer electronics.

Furthermore, Amazon's e-commerce platform benefits from an expansive global reach, a well-established logistics network, and a growing portfolio of private label products, which enhance its market share and profitability. Amazon's continuous push into new markets, such as grocery delivery and healthcare, demonstrates its ability to innovate and expand, leveraging its massive scale and data analytics capabilities to capture new growth opportunities.

This blend of established dominance in current markets and aggressive pursuit of new opportunities makes Amazon a compelling investment for those looking for exposure to a company with both stability and growth potential in rapidly evolving industries.

Microsoft (NASDAQ: MSFT)

AI Integration: Azure AI's significant 47% revenue growth in 2024 underscores the demand for Microsoft’s AI capabilities.

Sectoral Impact: Microsoft's AI technologies are vital in areas like digital healthcare, which has seen increased demand for AI-driven diagnostics and patient management systems.

Economic Scale: With a market cap nearing $2 trillion, Microsoft's scale and financial resources allow it to invest heavily in AI research and development.

Community Initiatives: Microsoft is also noted for its ethical AI commitments and programs aimed at democratizing AI technology access.

Microsoft (MSFT) has diversified and robust business model, which is deeply integrated into the infrastructure of the global digital economy. Microsoft's portfolio spans essential software products like Windows and Office, alongside rapidly growing segments such as cloud computing with Azure, enterprise services, and LinkedIn. Azure, in particular, stands out as a major growth driver, consistently gaining market share in the cloud industry against formidable competitors like AWS and Google Cloud. This growth is supported by the increasing demand for cloud services and Microsoft's ability to offer hybrid solutions that cater to both cloud and on-premise environments, making it a critical player in digital transformation trends across industries.

Furthermore, Microsoft's commitment to innovation in emerging technologies such as artificial intelligence, machine learning, and quantum computing positions it well for future growth. This combination of established business segments with new technological advancements provides a balanced portfolio that can generate steady revenue while also capitalizing on new market opportunities.

Image from Pcquest

Adobe (NASDAQ: ADBE)

AI-Driven Features: Adobe’s AI platform, Adobe Sensei, powers features across Creative Cloud applications, enhancing user creativity and productivity.

Financial Performance: In 2024, Adobe reported a revenue increase of 17%, with significant contributions from digital media solutions.

User Engagement: AI tools in Adobe products have led to improved user engagement, with Creative Cloud achieving a record number of subscriptions.

Expansion Plans: Adobe is expanding its use of AI in digital experience management, aiming to redefine customer experience platforms.

The reason why you should not give Adobe a miss is its strong position in the creative software industry, coupled with its successful transformation into a cloud-based subscription service model. Adobe's Creative Cloud suite, which includes industry-standard tools like Photoshop, Illustrator, and Premiere Pro, dominates the digital content creation market. This suite not only ensures a steady, recurring revenue stream through its subscription model but also continuously evolves with new features and capabilities that integrate cutting-edge technologies like artificial intelligence (AI) through Adobe Sensei.

Adobe's expansion into digital marketing and analytics with its Experience Cloud further diversifies its offerings and taps into the growing demand for digital marketing solutions, enhancing its growth prospects. This broad portfolio of essential services, combined with a consistent focus on innovation and customer retention, makes Adobe a compelling investment for those looking to benefit from the growth in digital media and online content creation.

Image from fullonapp.com

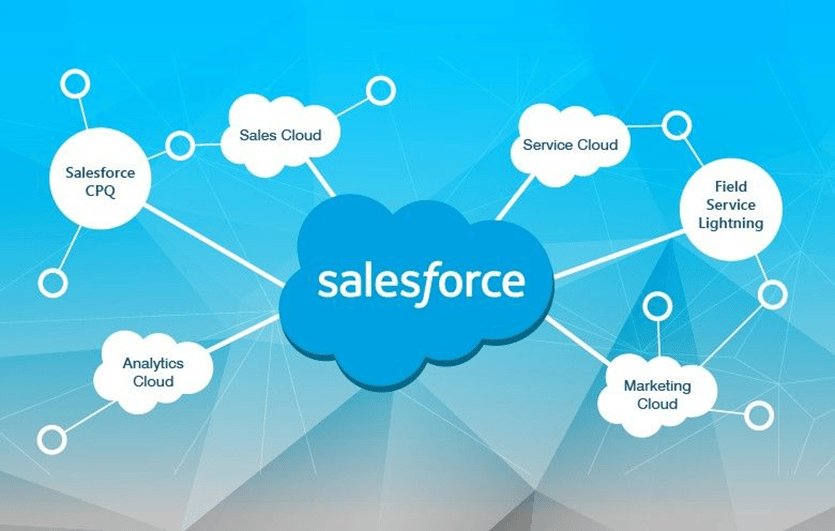

Salesforce (NYSE: CRM)

AI Capabilities: Salesforce's Einstein AI provides analytics and automated data insights across its customer relationship management platform.

Revenue Growth: Salesforce reported a 22% increase in revenue in 2024, bolstered by the integration of AI into its services.

Strategic Acquisitions: The acquisition of Slack for $27.7 billion enhances Salesforce's collaboration tools with AI-driven insights.

Market Influence: Salesforce’s strategy focuses on using AI to improve enterprise efficiency and customer satisfaction.

The most compelling reason to invest in Salesforce (CRM) lies in its leadership and innovation within the cloud-based customer relationship management (CRM) sector. Salesforce has consistently expanded its product offerings beyond traditional CRM to encompass a full suite of business applications, including marketing, analytics, and customer service platforms. This diversification helps organizations of all sizes to streamline their operations and enhance customer interactions in a digital-first world.

Additionally, Salesforce's commitment to integrating artificial intelligence through its Einstein platform across its services enhances its attractiveness. Einstein AI delivers advanced analytics, predictive insights, and increased automation capabilities, making Salesforce's tools even more indispensable to businesses looking to improve efficiency and decision-making processes. Salesforce's strategic acquisitions, like Tableau and Slack, further extend its ecosystem, providing more comprehensive data insights and improving collaboration within businesses. This forward-thinking approach not only maintains Salesforce's competitive edge but also continuously opens new avenues for growth, making it a strong investment choice in the evolving tech landscape.

Conclusion

These companies are not only leveraging AI technology to enhance their offerings but are also pioneers in the field, driving AI's adoption across industries. For investors, these stocks offer a blend of innovation, strong market presence, and robust financial health, making them ideal candidates for those looking to invest in AI’s growth potential.